Understanding Outcome-driven Strategy

May 06, 2024

A/B testing is not a strategy.

Algorithms are not a strategy.

Dashboard analytics driven decision making is not a strategy.

A list of tactics tied to arbitrary KPIs isn't a strategy.

Yet, this still seems to be the prevalent modus operandi across the spectrum of product teams today.

Teams will proudly A/B test 41 shades of blue, analyzing data to select the best performing option, rather than stopping to think critically about whether or not the color blue even relates to a desirable outcome for the growth of their product. We happily relinquish our product strategy to algorithmically generated recommendations, rather than making the effort to think deeply about what customers might actually want, in a way that's more than the sum of their clicks.

Sure, it sounds obvious, yet the direction of many digital products are still driven by these processes. Many teams have fallen into the trap of data obsession and knee-jerk reactions to surface level sentiment. It's hard to blame them.

Product strategy seems to have been replaced by the product stack: an infinite array of tools providing analytics and A/B testing for anything and everything you could imagine. Dashboards tracking metrics are updated instantaneously in real-time for instant validation, gratification and confirmation bias.

Enter the KPI psychosis of the modern product team.

A/B testing and multi-choice surveying your way through every decision while hiding behind analytics dashboards.

This is the easy way.

This is results-driven strategy.

Slow is the new fast: Doing it the hard way with outcomes

Thinking big is hard.

Breaking those big, abstract, ideas into logical, digestible and executable steps is even harder.

Committing to a direction without instantaneous feedback to validate your hypothesis is hard.

Waiting months, or even years to see outcomes as a result of your effort is even harder.

Stepping away from the dashboard and defining a clear vision for what your product could be and what you really should be doing is hard.

These are hard things to do. But they are worth doing.

We need to think bigger. We need to commit to a direction and stop living quarter to quarter.

We need to understand that people aren't in love with the products we create. Instead, they love how it makes them feel, what it enables them to do and where it takes them to. Our mission is to think critically about what that is and how it connects to the business, then codify that into an executable strategy.

This is outcome-driven strategic thinking.

This is the difference between simply increasing market share and increasing your total addressable market with an unfair advantage.

Yes it's hard, and ambitious, but if you are serious about creating a lasting product strategy then this is the way.

Thinking big with outcomes: Changing the way people think

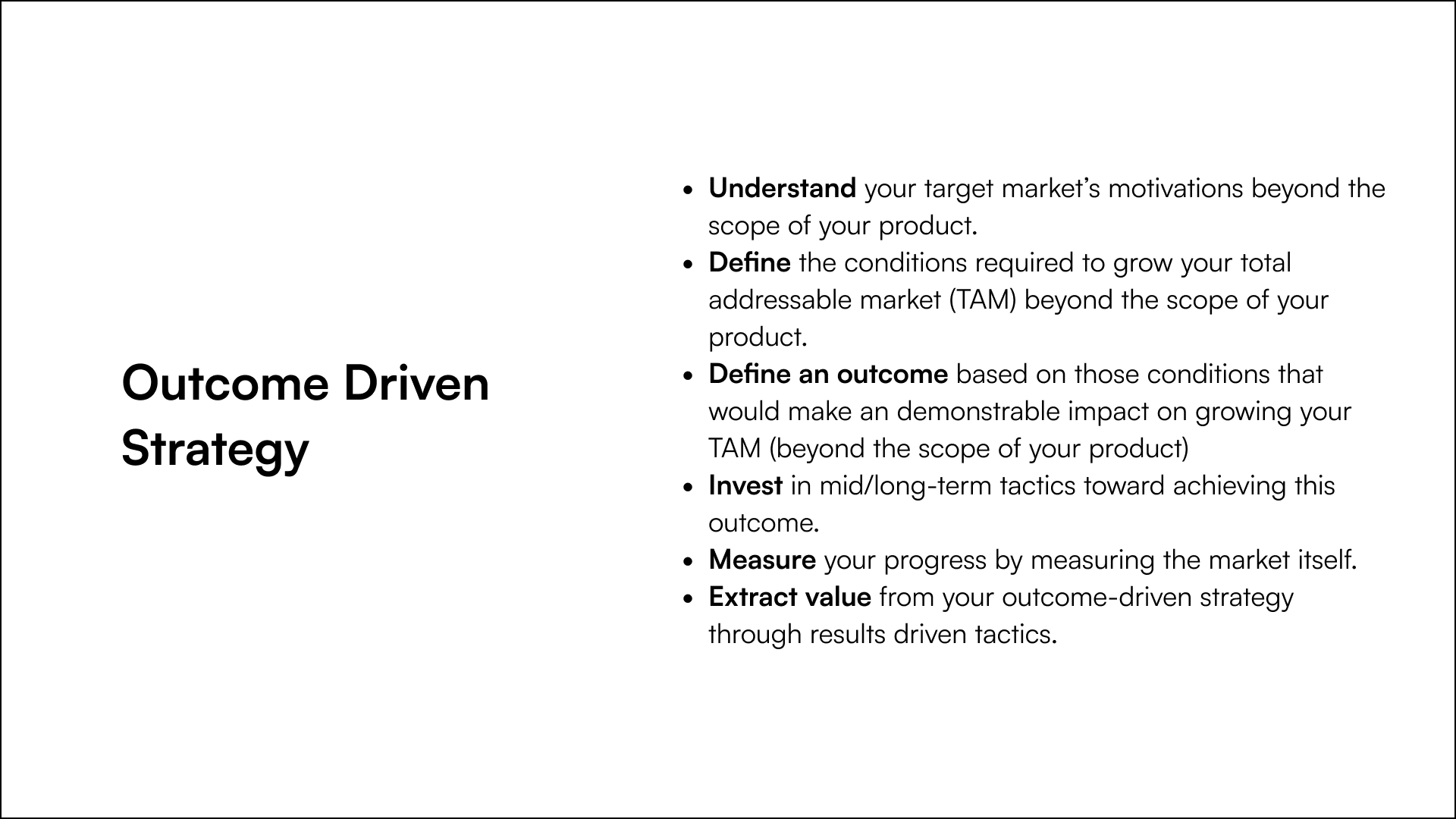

Outcome-driven strategy is about defining a desired state for your target market (vision) and the actions needed to realize that state. Unlike results-driven strategy that optimizes for extracting value from the an existing state, outcome-driven strategy is about creating a demonstrable change to the way people think and behave to manifest that desired state.

Outcome-driven strategy is about defining a desired state for your target market (vision) and the actions needed to realize that state. Unlike results-driven strategy that optimizes for extracting value from the an existing state, outcome-driven strategy is about creating a demonstrable change to the way people think and behave to manifest that desired state.

So what does thinking big with outcomes look like?

In April 2016 Airbnb launched their "Live There" campaign. This campaign was significant because it marked a shift in their marketing strategy. "Live There" was a campaign optimized for an outcome. In a competitive market of travel accommodation Airbnb thought big about changing the way people think about their product and how to shift the narrative of travel toward an outcome that would benefit their business model. Rather than going head-to-head with hotels in the zero sum game of the existing market, instead they choose ambitiously to change the way people think about travel and create a new addressable market where they were better equipped to compete.

The hypothesis of the "Live There" campaign is that a segment of their users used Airbnb because they valued authenticity, connection and experiencing a place as if they were living there. By delving deeper into what travelers really wanted, Airbnb they found that 55% sought a more local and authentic experience. Airbnb repositioned themselves from providing travel accommodations to providing authentic travel experiences. The success of the campaign validated their hypothesis as it resonated with many travelers disillusioned with the often soulless and manufactured experiences of hotels and tours.

True to outcome-driven strategy Airbnb knew they needed to continue pushing toward their desired outcome growing their addressable market for authentic travel experiences. They followed up on their strategy quickly launching Experiences in November of 2016. In line with their "Live There" ethos, Experiences continued to shift the narrative of travel toward more authentic local experiences by allowing travelers to book unique local activities hosted by locals. The thought leadership of the "Live There" campaign followed up with the tangible execution of a new product to complement that narrative is an excellent example of outcome-driven strategic thinking.

But they didn't stop there. Fast-forward to May 2024 and Airbnb announces yet another addition to their vision: Icons.

While their positioning for providing unique and authentic travel experiences was ambitious, Icons is even more so. Through Icons, Airbnb continues to commit to their positioning, further distancing themselves from the traditional travel accommodation market with a new halo product providing experiences that until now only existed in our imaginations. From changing way the people think about traditional travel experiences to creating the destination itself, it's clear that someone at Airbnb is thinking big about outcome-driven strategy.

Outcomes: Accelerating the growth of your addressable market

Sometimes outcome-driven strategy is not so much about attempting to change or create new markets and more so about accelerating the growth of the existing market.

For Stripe this is exactly the outcome they are optimizing for. Initially a payments solution for internet businesses, Stripe has grown to be much more. From the beginning Stripe viewed it's total addressable market as the entire economy of the internet, including nearly every business that engaged in online commerce and payments. As a fast growing business the bottleneck to Stripes growth was the market itself.

Stripe's ambitious desired outcome was to accelerate the growth of the digital economy of the internet, defined clearly in their mission to "increase the GDP of the internet." So what was the hypothesis? Stripe understood that their users valued their product because it was much easier and faster to implement than any alternative. Stripe's users loved that Stripe enabled them to spend more time focused on building their product. Stripe hypothesized that by simplifying the process for teams to establish and operate businesses, they could potentially speed up the expansion of the digital economy.

In 2016 Stripe tested that hypothesis with a new product: Atlas. For $500, in just a few clicks Atlas provides a streamlined way for startups to incorporate in the United States, online from anywhere. The globally available, cheap, and streamlined service for incorporation abstracted away the logistical complexities providing founders with the foundation required to access investment capital. Over the first five years Atlas enabled more than 20,000 businesses to incorporate that collectively generated over $3 billion in revenue.

By lowering barriers for starting an internet business, Atlas enables more businesses to participate in the online economy directly linking to it's mission of "increasing the GDP of the internet."

Similar to Airbnb, Stripe continues to bet on their hypothesis. In 2019 Stripe launched Stripe Capital to make it faster and easier for internet companies to access financing. As a product not only does it align precisely with their outcome strategy, but Capital also leverages Stripe's unfair advantage by utilizing the data from Payments to quickly access the financial health of a business without requiring extensive paperwork of financial audits.

This continuous commitment to their mission has led Stripe to becoming the benchmark for success in valuation, innovation and market impact. What initially seems like an abstract mission to "increase the GDP of the internet" has been adeptly translated into tangible results.

The death OKRs and results-driven strategy

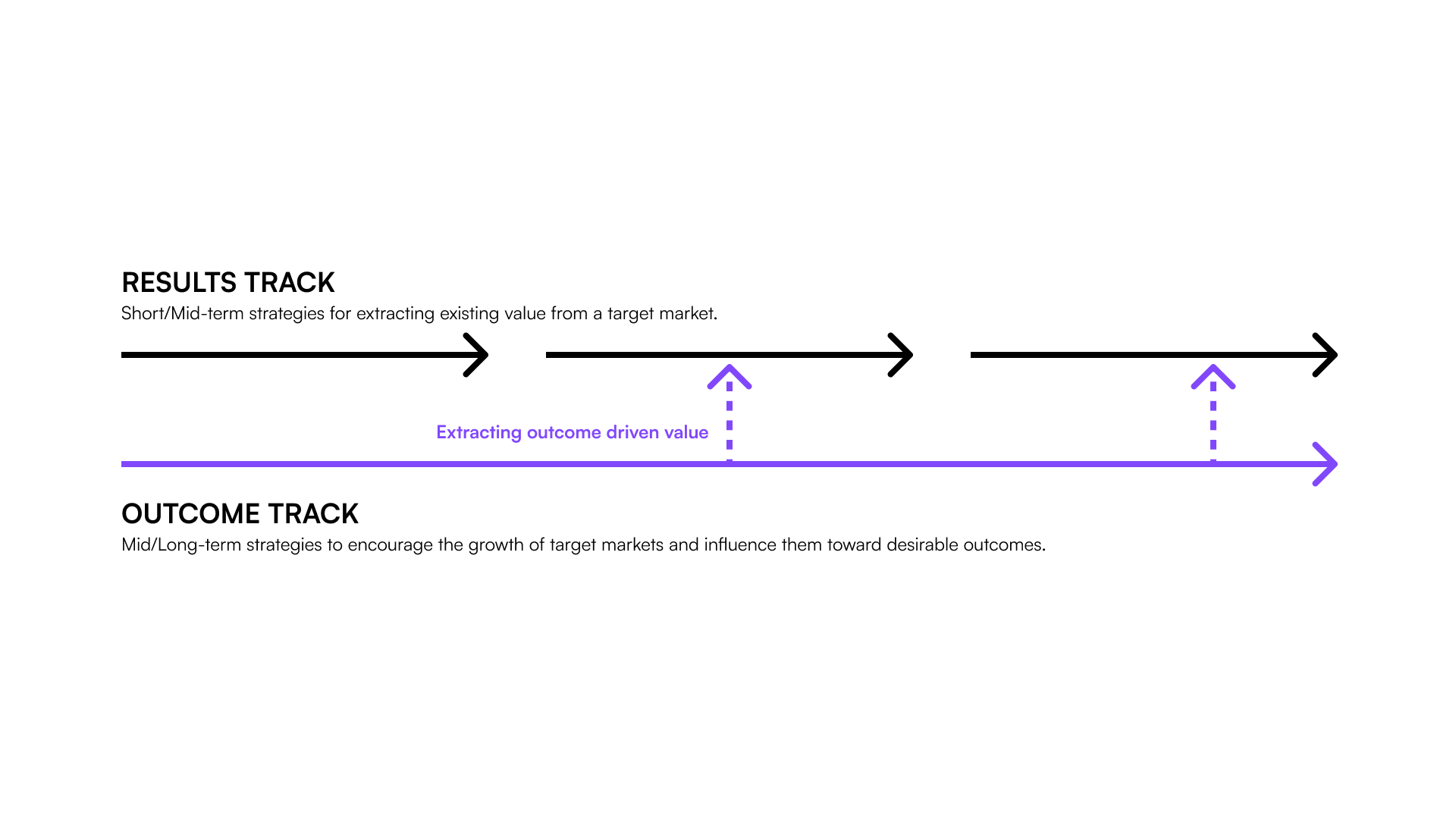

So is this the end for results-driven strategy? Can we uninstall our analytics, close our dashboards and throw away our OKRs? Far from it. Outcome-driven strategy doesn't exist in a vacuum. In fact it happily co-exists and complements results given strategy:

Outcome-driven strategy is optimizing for tomorrow while results-driven strategy is about getting the most out of what we can today.

Outcome-driven strategy is optimizing for tomorrow while results-driven strategy is about getting the most out of what we can today.

Outcome-driven strategy is how we create compounding value at the macro scale over the mid to long term. Results-driven strategy is how we extract that value at the micro more localized scope of the products you offer.

As the effects of your strategy manifest and compound toward the growth of your target market you'll be able to take a larger slice of a growing pie or own the pie itself with an unfair advantage.

Measuring outcome-driven strategy

For all the benefits of outcome-driven strategy, the downside is that it can take a long time to see the effects and those effects can be challenging to assign OKRs to for measurement. Again, the goal is not to throw away results-driven strategy; so we still need to think about measurement even if it is hard to define. What are good ways to measure the effects of an outcome-driven strategy? Well if your desired outcome is change the market, measure the market itself.

Take Figma for example.

Figma's mission is to "make design accessible to everyone." For Figma's core product "Figma Design" I see this mission as clearly aligning to a desired outcome. As an designer advocate I've spent a lot of time thinking about desired outcomes for Figma and how to achieve them. Primarily a design tool for product teams, I see the total addressable market for Figma Design as the number of businesses that value design and the collective size of their teams that engage in design.

So the desired outcomes would naturally be increasing the number of companies that value design and invest in it, and increasing the average design maturity level of the market (value created by design). To achieve this Figma needs to effectively grow and up-level the global product design industry. As with most outcome-driven strategies, this is ambitious.

To measure the results of our progress we can measure the growth rate of the design industry. Tracking metrics such as the number of design driven top 500 companies and their growth rate in a market, the growth rate of product design related jobs and demand for designers, or even more directly with a total economic impact report for Figma. Combined, metrics such as these can effectively measure the growth of the "GDP of Design", a barometer for success.

While defining OKRs can be challenging, with some creative thinking it's possible to measure them by looking outside of your product and into the greater effects and behavioral changes on your target market.

What's next?

While outcome-driven strategy isn't new, the number of businesses committing to outcomes and successfully executing with this approach is still few and far between. If you've managed to find this article and read this far, the good news is that maybe your competitor hasn't and at a time where businesses are growing faster than the market they serve, now's a great time to start thinking about your own outcome-driven strategy.

If you are interested in defining an outcome-driven strategy with design, check out Intro to Design Strategy or book an intro call.